Cool heads required as European carbon allowances face increased volatility from political risk

This blog was originally published here, and is part of a series of regular updates on the EU carbon markets.

EU carbon allowances, or EUAs, suffered another difficult week on regulatory and political worries, with the benchmark Dec-26 contract settling at €78.73/t on Friday, down 3.1% on the week. The drop was attributable to media articles reporting potential changes to the methodology for free allocation and a misunderstanding in the market about the so-called “buffer reserve” of allowances – technically known as the cross-sectoral correction factor (CSCF) allowances – held back under Article 10a (5)a of the EU-ETS directive.

As we explained in a post last week, these CSCF allowances were always going to come to market over 2026-30 one way or another, and so should already be in consensus forecasts. Indeed, it was noteworthy that EUA prices increased sharply yesterday (Monday, February 9) as the market appeared to digest this idea more soberly.

Today, however, there has been a further shock to the market with the well-known Member of the European Parliament Pieter Liese – who previously led the Parliament’s work on the EU-ETS – commenting to journalists as reported by Bloomberg that changes to the EU-ETS under the forthcoming EU-ETS Review (due in Q3 of this year) could include a slowdown in the rate of phase-out of free allowances from 2029 and a lower Linear Reduction Factor (LFR, i.e., the annual cap adjustment rate) of 3.4% (versus the current 4.4%) from 2029.

The market crashed €2.85/t in the 10 minutes from 12.50-1pm CET after these headlines hit the wires – from €81.79/t to €78.94/t – before recouping much of the lost ground over the following 40 minutes to €81.12/t. Subsequently, it has dipped below €80/t again as the market digests exactly what these latest comments mean and how supply and demand might be affected from 2029 onwards under such a scenario.

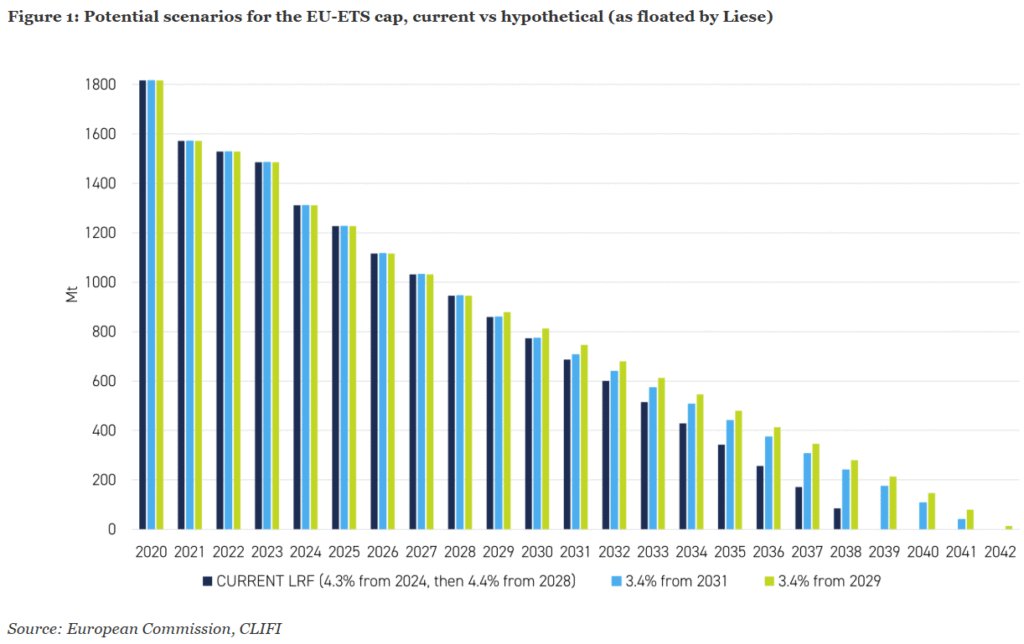

With this in mind – and bearing in mind that, although still an influential figure in Brussels, Peter Liese is only giving his personal opinion here, not a formal negotiating position on behalf of a given bloc in the Parliament – we have modelled the implications of a reduced LRF over 2029-40 and 2031-40 to give an idea of what such a change would mean for the market (Figure 1).

As can be seen, under the existing legislation, the LRF is constant from 2028 at 4.4% and falls to zero in 2039.

We then model two hypothetical scenarios based on Peter Liese’s comments as reported by Bloomberg.

In the first hypothetical scenario, we model the cap’s trajectory with a lower LRF of 3.4% starting in 2031. This would be a more natural break with the current legislative framework, as 2031 marks the formal start of the next trading period (2031-40). Under this scenario, instead of reaching zero in 2039, the cap would hit zero in 2042.

In the second hypothetical scenario, we model the cap’s trajectory with a lower LRF of 3.4% starting in 2029. This would be a very disruptive way of changing the cap’s trajectory, as it would mean that the LRF would increase to 4.4% in 2028, as currently foreseen in the existing legislation, only for it then to be reduced to 3.4% in 2029, and for this reason, we think it would be much less likely than a reduction from 2031. Under this scenario, instead of reaching zero in 2039, the cap would hit zero in 2043.

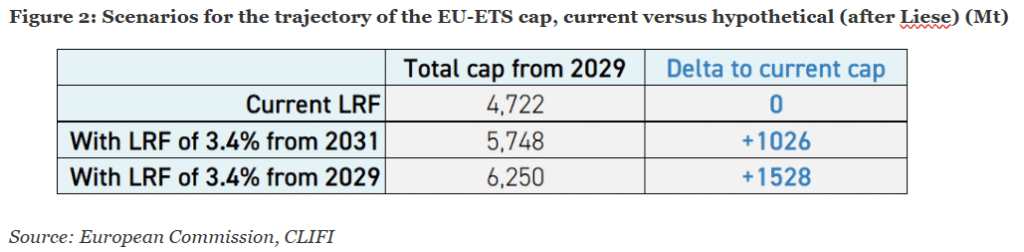

Under these two hypothetical scenarios, the total cap available to the market from 2031 and 2029 onwards, relative to the current legislation, would increase by 1,026Mt and 1,528Mt respectively (Figure 2, Delta to current cap).

While these seem like big numbers, it is important to emphasize that the vast majority of the increase in the cap that would accrue from the changes implied under these two hypothetical scenarios would occur from 2036 onwards.

Looking at our first hypothetical scenario, of the total increase in the cap of 1,026Mt only 293Mt of that would be realized over 2031-35, with the remaining 733Mt increase happening over 2036-41. In other words, 70% of the total implied increase in the cap would happen between 10-14 years from now.

Regarding our second scenario, of the total increase in the cap of 1,528Mt only 547Mt of that would be realized over 2029-35, with the remaining 981Mt increase happening over 2036-41. In other words, 65% of the total implied increase in the cap would happen between 10-16 years from now.

In short, and emphasizing that all of this is only hypothetical at the moment in any case, any change to the trajectory of the cap along the lines of the notion floated by Peter Liese to journalists this morning would not have any meaningful impact on the supply/demand balance in the EU-ETS before 2035 anyway. Perspective is therefore in order.

The EU-ETS Review and the MSR Review scheduled for Q3 this year will undoubtedly cause more market-moving headlines in the coming weeks and months, but nobody should doubt the EU’s continuing resolve to achieve its 2040 emissions-reduction target, as Peter Liese himself also emphasized in his comments this morning.

Mark Lewis is a partner and managing director at Climate Finance Partners. He has previously held senior roles at Andurand Capital, BNP Paribas Asset Management, Barclays, Kepler Cheuvreux, Deutsche Bank, Carbon Tracker and E.ON.

Mark was a member of the original Taskforce on Climate-related Financial Disclosures, and a senior associate at the Cambridge Institute for Sustainability Leadership.