Why are the private sector’s net zero pledges such a mess?

Good intentions, sloppy language, data and the permafrost all contribute to Race to Zero’s fudged requirements

The first thing Race to Zero says about credible net zero commitments is that they must cover all greenhouse gas emissions.

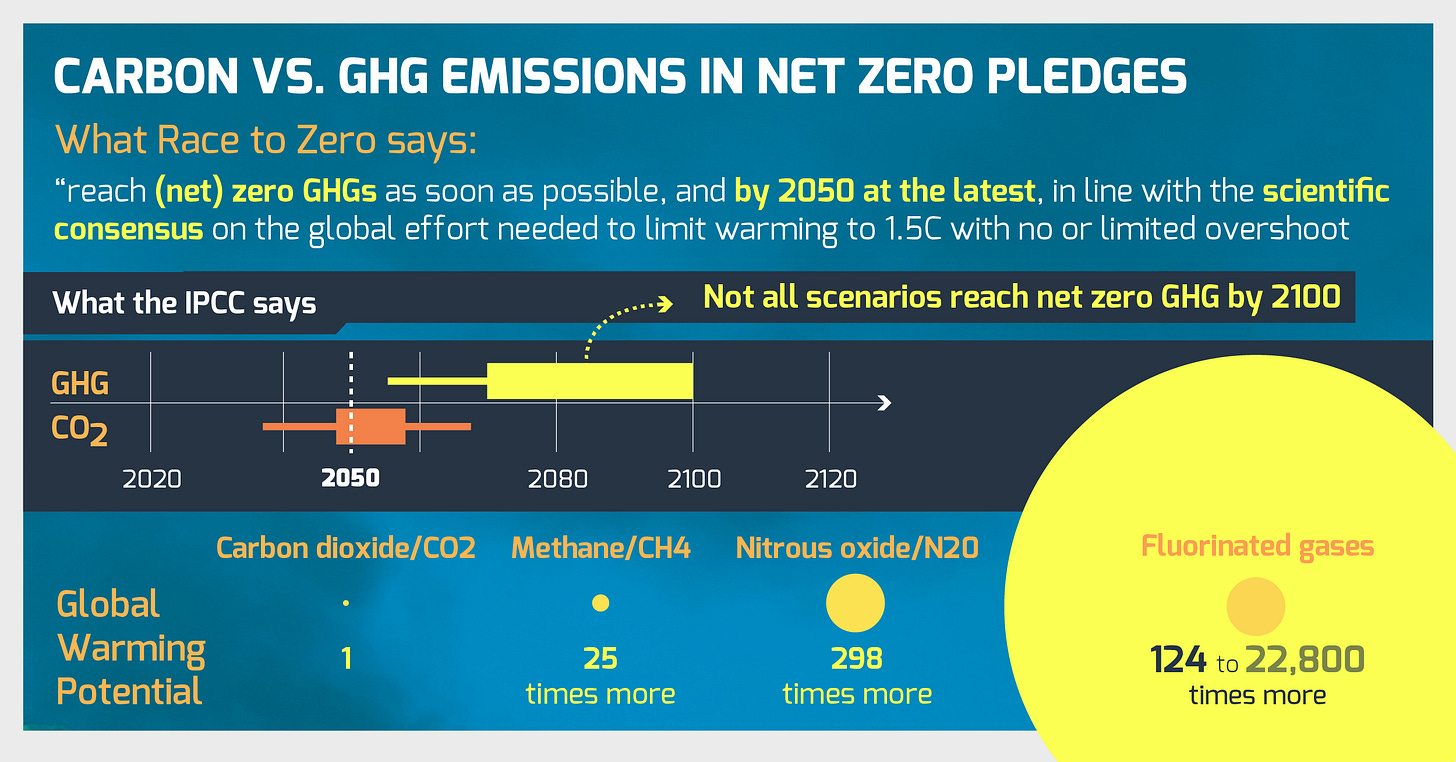

The UN body, which coordinates many of the world’s most important climate commitments, requires all members to “pledge at the head-of-organisation level to reach (net) zero GHGs as soon as possible, and by 2050 at the latest, in line with the scientific consensus on the global effort needed to limit warming to 1.5C with no or limited overshoot.”

When asked what “scientific consensus” Race to Zero was referring to in this statement, a spokesperson told REP that its target “is based on the IPCC Report on Global Warming of 1.5C and in the IPCC’s 6th Assessment Report, which are formulated around the 1.5C target”.

But the IPCC does not require GHG emissions to be at net zero by 2050. It says that, in order to remain below 1.5C, only carbon needs to meet that deadline. Its top-level estimates for broader emissions is around 2095, but it acknowledges that even this may not be accurate.

Race to Zero is not the only one to cite the IPCC report imprecisely. After describing the IPCC as “our scientific North Star” during a speech in November – and insisting that net zero pledges are fully aligned with its scenarios – UN Secretary General Antonio Guterres said: “That means global emissions must decline by at least 45 per cent by 2030 – and reach net zero by 2050… and these targets must cover all greenhouse gas emissions…”

Jakob Thomae, co-founder of think-tank 2 Degrees Investing Initiative, says the mismatch is driven by “a mentality in the climate movement that the ends justifies the means – that it’s okay to cut corners on the IPCC’s exact specifications in order to raise climate ambitions”.

“This comes with costs,” he argues. “And in this case that includes the likelihood that many financial institutions and companies will be surprised to find out about this delta, because they trust Race to Zero to represent the climate science precisely, and that’s not what’s happening here.”

That could result in withdrawals or backsliding from institutions over time, but it may simply contribute to a sense that emissions pathways are malleable.

“So there are hidden costs to these good intentions,” says Thomae. “If by trying to be more ambitious you deviate from the science, you risk undermining the pathways we need to see, and by extension the ultimate ambition of pledges that orientate themselves around Race to Zero.”

Those pledges come from more than 10,000 institutions that belong to one of Race to Zero’s 28 subgroups. Members range from universities and football clubs to starts-ups and cities. There is even a group dedicated entirely to Scotch whisky producers. Crucially, thousands of the world’s biggest companies, asset owners and asset managers are signed up to Race to Zero.

So why have they all committed to outpace the IPCC on GHG reductions?

Well, the truth is, they haven’t. In another problem for Race to Zero, some subgroups appear to have ignored its first rule.

Around 200 companies are part of a subgroup called The Climate Pledge, for example, coordinated by tech giant Amazon and NGO Global Optimism. The Climate Pledge describes itself as “a commitment to reach net-zero carbon emissions by 2040”. There is no mention of broader greenhouse gases.

The conveners of The Climate Pledge did not respond to a request for comment about why it joined Race to Zero despite not meeting its criteria. Neither did Race to Zero.

Race to Zero also did not provide any concrete explanation as to how it had calculated the 2050 target for GHG emissions. Instead, it told REP that “many actors have been rallying behind this target for years”, adding that it was keen to push ambition, and that it’s necessary to start reducing GHG emissions immediately. But nothing about why it has told the private sector that scientific consensus requires all emissions to be at net zero by 2050.

Beyond Co2, the main greenhouse gas is methane, which accounts for 20% of global emissions (and more than a quarter of current global warming, according to the UN). When private-sector actors talk about GHG emissions, they are usually either using it synonymously with carbon emissions, or they are talking about carbon + methane.

According to the IPCC’s median scenarios, reaching net zero methane will take until about 2072 – roughly halfway between average carbon and GHG deadlines.

Strip out those methane emissions that the private sector can’t directly influence (the melting of the permafrost, for example) and you’re left mainly with emissions from oil & gas and some agricultural activities. The calculations are even more speculative here, but some experts from net-zero committed entities says these sectors – especially oil and gas – require steeper reductions in methane, bringing the deadline closer to 2060.

So while it’s hard to see how any scientific consensus points, as Race to Zero suggests, to a need for all GHG emissions to be at net zero by 2050, the deadline for reducing carbon and methane emissions that fall within the private sector’s direct control could be closer to mid-century than the IPCC’s top-level estimates suggest.

The Net Zero Asset Owner Alliance told REP that its commitment to reduce all GHGs to neutrality by 2050 was “slightly more ambitious than the IPCC scenarios”, but said that “the majority of emissions in a financial portfolio will be related to CO2.”

“Data remains rarely disaggregated between GHG types and is often reported as CO2 equivalent (CO2e), which is still mostly comprised of just CO2,” a spokesperson continued. “For these reasons, the Alliance has maintained the ‘letter’ of the commitment and for the current period advocates for rapid reductions across all GHGs inclusive of CO2, methane, nitrous oxide and others towards 2050.”

The Net Zero Asset Managers initiative, which has also adopted the Race to Zero’s deadlines on GHGs, echoed the point on CO2e data, which it described as “a proxy for measuring all seven Kyoto greenhouse gases and recommended by the GHG protocol”.

“Although IPCC scenarios are based on CO2, measuring and reporting CO2e is more practicable for investors and underlying assets,” a spokesperson continued, adding that limiting the focus to carbon could “disincentivise investors to engage and reduce emissions from sectors such as agriculture, i.e. methane.”

In addition to data limitations and complex science, there is also public mood to think about. The past 18 months have seen the credibility of key net zero groups like GFANZ plummet. Narrowing the criteria to focus on carbon emissions now is likely to be perceived as an exercise in watering down ambition, rather than an act in pursuit of scientific accuracy.

But, says Thomae, by not following the exact science, Race to Zero risks providing climate sceptics with ammunition that could undermine the climate movement. “From that vantage point, notionally reducing ambition in line with the IPCC science may actually increase the climate impact.”