Listed companies will exhaust carbon budget by 2026, says MSCI

Research also finds the level of firms disclosing Scope 3 emissions has doubled in three years.

Listed companies are continuing to burn through their carbon budget too fast, and will now run out of their collective emissions quota by August 2026, according to MSCI.

The data giant has released an update to its ‘Net Zero Tracker’, concluding that Scope 1 emissions from the constituents of the All Countries World Investable Market Index (ACWI IMI) are continuing to rise, rather than stabilising or decreasing.

“To limit warming to 1.5°C, listed companies would need to collectively cap future Scope 1 emissions at 33.4 Gt of CO2e by 2050,” MSCI explained. “Without any change to their current emissions of roughly 12.4 Gt a year, listed companies would deplete their remaining emissions budget in 2 years, 8 months.”

Last year, the Net Zero Tracker put that depletion date at December 2026.

To stay within 2°C – the cap originally imposed by the Paris Agreement – the current trajectory would give listed companies 16-and-a-half years.

“While a 1.5°C-aligned pathway for such companies remains theoretically possible, it looks increasingly unlikely that they can decarbonise in time to avoid using up their share of the global GHG-emissions budget for limiting the rise in average global temperatures to 1.5°C,” MSCI warned.

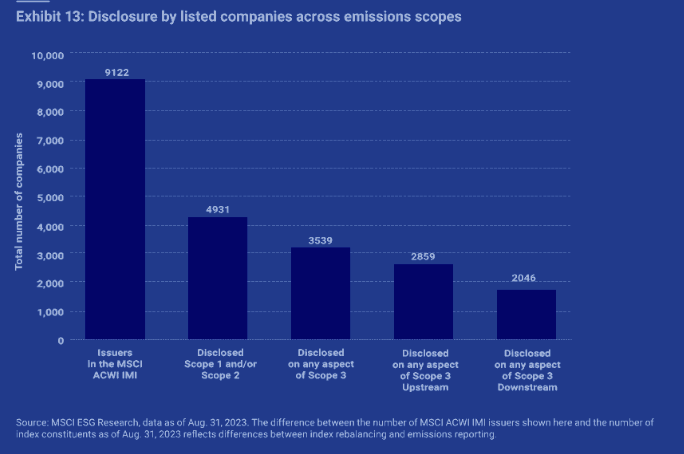

In addition, the research found that the proportion of ACWI IMI constituents disclosing at least some of their Scope 3 emissions – those generated in their value-chains – had risen from 18% three years ago to 39% by August 31 this year.

“Taking inventory of Scope 3 emissions is getting easier as carbon accounting improves, yet reporting them remains a challenge because it requires companies to tally emissions from both upstream and downstream in the value chain,” MSCI said.

“Still, international standards and regulatory requirements reflect a growing consensus that reporting of Scope 3 missions delivers the clearest picture of companies’ exposure to climate-related risks and opportunities.”