Carbon price in the EU ETS to hit €126/t by 2030

Reducing benchmarks and planned free allowance phase-out drive expectations for price increases, explains Andrii Glushchenko

This blog was originally published on the GMK Centre website, here.

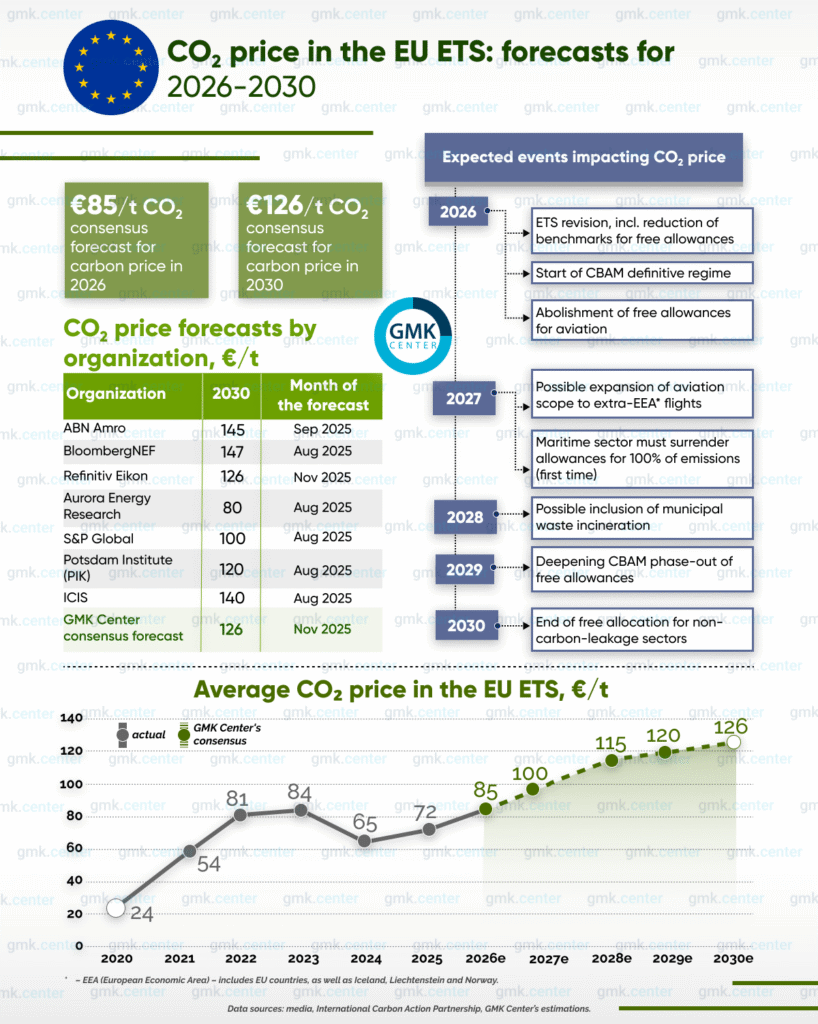

A consensus forecast compiled by GMK Centre projects the average price of EU carbon allowances (EUAs) will reach €126 per ton of CO₂ by 2030. This figure represents a median of expert forecasts from key research companies and institutions, including BloombergNEF, ABN Amro, Refinitiv, Independent Commodity Intelligence Services, S&P Global, Aurora Energy Research, and Potsdam Institute for Climate Impact Research.

Despite notable differences between institutional forecasts (ranging from €80 to €147), the consensus suggests robust expectations for continued upward movement of carbon prices in the EU Emissions Trading System (EU ETS). The wide range underscores uncertainty over the speed and intensity of decarbonisation, possible energy market dynamics, and climate policy implementation across Europe. The average CO₂ price is projected to reach €85 /t (+18.1% y-o-y) in 2026, and cross into triple digits by 2027 (€100/t). Further growth will be aimed at moving closer to the 2030 consensus.

Multiple regulatory developments are expected to reshape the carbon market landscape through 2030, amplifying demand for carbon allowances. The most impactful changes are anticipated in 2026, including the revision of the EU ETS that will lower benchmarks for free allowances, and the full implementation of the Carbon Border Adjustment Mechanism (CBAM), which will further reduce the volume of free allocations available to industry.

Upward price pressure will be primarily driven by gradual phase-out of free allowances. In 2026 sectors which don’t face significant carbon leakage will receive up to 30% of carbon allowances for free, but in 2030 free allocation for such sectors will end. For CBAM goods free allowances will end in 2034 according to current regulation. Some analysts expect reinforcement of the Market Stability Reserve (a mechanism designed to reduce the surplus of emission allowances in the EU ETS and improve market stability) to absorb surplus EUAs more intensively.

High gas prices may also contribute to rise in carbon prices. When gas becomes more expensive, power producers tend to switch to coal, which is more carbon intensive – this increases emissions and, consequently, demand for carbon allowances.

On the other hand, industrial decarbonization efforts supported by subsidies and the ongoing expansion of renewable energy may help alleviate upward pressure on carbon prices. In addition, by 2026 the European Commission is expected to evaluate the potential integration of permanent carbon removals into the EU ETS. Such Carbon Dioxide Removal activities, which extract CO₂ directly from the atmosphere, could serve as the basis for generating carbon credits that would coexist with EUAs on the market. While these developments may offer alternative compliance options and reduce demand for carbon allowances, their overall impact is likely to remain limited within the current decade.

As previously reported by GMK Center, European carbon prices exceeded €80/t in November. This was due to improved sentiment in energy-intensive industries amid Germany’s plans to introduce measures that will help reduce electricity costs for such sectors starting in January 2026.  Further market direction will depend on spreads between different fuel types, electricity demand in winter, and the volume of quota offers at auctions.

Further market direction will depend on spreads between different fuel types, electricity demand in winter, and the volume of quota offers at auctions.

Andrii Glushchenko is an analyst at the GMK Centre, a Ukrainian-based consulting company with the focus on European steel market.